BY MATTEO LUCCIO / CONTRIBUTOR / PALE BLUE DOT LLC

WWW.PALEBLUEDOTLLC.COM

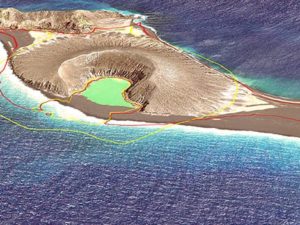

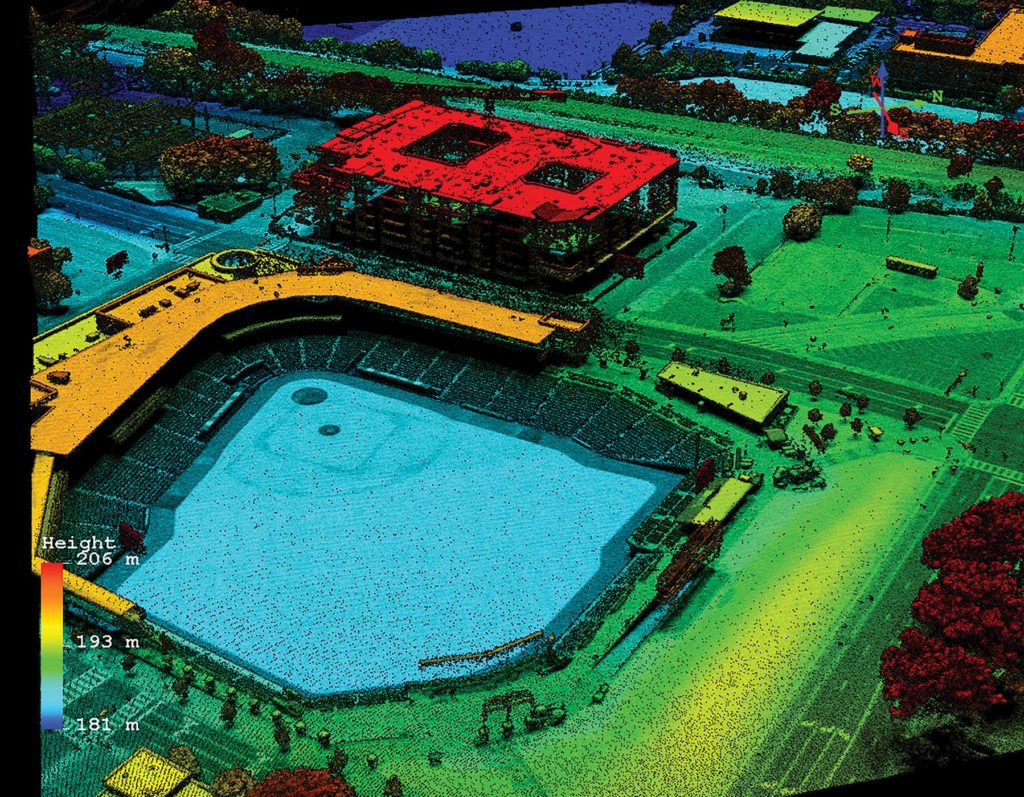

FIGURE 1.

The Harris Geiger-Mode LiDAR wide-area mapping system captures 3D point cloud information at densities exceeding 100 points per square meter

The Line Between vendors of Geospatial Software and providers of geospatial data is increasingly blurred, as more companies either provide both or partner with complementary companies. An example is a new joint offering among Harris Geospatial Solutions, DigitalGlobe, and Esri. The emphasis in the geospatial industry is increasingly on easy-to-use mobile applications that can be deployed on all major platforms, ingest external data, and run offline.

For this seventh and final installment in this series, I interviewed Peter Batty, CTO of the Geospatial Division of Ubisense, and Stuart Blundell, Director of Strategy and Business Development for Harris Geospatial Solutions, a business unit within the Harris Space and Intelligence segment of the Harris Corporation. Between them, they have more than 60 years of experience in the geospatial industry.

UBISENSE

This series has been exploring the offerings of a wide range of geospatial companies, addressing different problems in different verticals and often focused on very specific application areas and markets. This diversity shows that geospatial technology has been maturing and becoming more commoditized, says Batty. His company is working on Web and mobile solutions, mainly for utilities and communication companies, using a lot of open source software.

Batty, who was previously CTO at Intergraph and at GE Smallworld, has been quite involved in open source software in the past decade. He sees the possibility of Ubisense expanding in the future into new markets that share key characteristics with utilities and telecoms, such as local government or transportation, a space in which he has worked for a very long time. “We have a Web and mobile application called myWorld that addresses that market,” he says. “We really try to deliver applications that leverage geospatial data and are simple to use for the 95% of the people in an organization who don’t know how to use GIS, such as field technicians, operations people, and customer service representatives.”

The advent of Google Maps, he recalls, changed the industry, as customers began to ask him why their expensive enterprise GIS was not as fast and as simple to use as Google Maps. In response, says Batty, Ubisense delivered a product “very much in the style of Google Maps,” which it also uses as a data source. However, after starting out using the Google Maps JavaScript API, over time Ubisense transitioned to using a lot of open source code as the basis for its products, such as a Leaflet JavaScript API in the PostGIS open source database. “I’m very impressed at the capabilities of geospatial open source software these days,” says Batty. “We’ve certainly used it to build some very large and robust implementations.”

Ease of use is a key focus for Ubisense, says Batty. He thinks that it is “deceptively hard to achieve,” especially for the traditional GIS vendors, who struggle to make software for nontechnical end users. “When you’re used to having these very powerful products, it’s really quite hard to leave functionality out.” Ubisense is proud of the top score it received for usability in a user satisfaction survey that one of its customers, a very large U.S. cable company, does every time it rolls out a new IT system.

Ubisense is a Google business partner and therefore can resell Google licenses. Typically, companies use Ubisense inside their firewalls, so they have to pay for the use of Google Maps, which they can buy either through Ubisense or directly from Google. However, Batty points out, Ubisense is not exclusively tied to Google. Because its software is built on open source, its users can take advantage of similar map services from other companies, such as Bing, MapQuest, or OpenStreetMap (OSM). Ubisense also makes a lot of use of OSM data for off line applications, which Google doesn’t allow with its data.

Another key focus area for Ubisense is integration. In general, Batty explains, a primary data source for his company is its customers’ detailed network and asset data in their enterprise GIS. The dominant GIS vendors in the utilities market are GE Smallworld, Intergraph, and ESRI; the telecom market also uses spatialNET from Synchronoss. Ubisense has systems that integrate with all four of those platforms. Therefore, Batty says, “myWorld gives our customers a sort of near real-time view of what’s happening across their enterprise.”

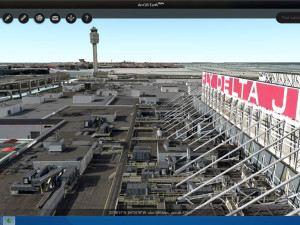

FIGURE 2.

Ubisense product myWorld with gas utility data running on an iPad, with the data available online or offline

FIGURE 3.

myWorld showing the same gas utility data on an iPhone, with a simplified user interface suitable for the smaller mobile screen

Ubisense’s biggest focus in the past couple of years has been on developing mobile applications. According to Batty, this is an area on which the major GIS vendors have not focused as much or in which they don’t have a very coherent strategy. “The nature of what you can do with mobile applications has changed dramatically in recent years,” he says, “in particular with the development of modern tablets and smart phones and widespread wireless networks.” By contrast, large enterprises are often slow to adopt these changes; therefore, they mostly rely on mobile solutions that predate them. “They’re often running on quite old Windows devices and are not designed to take advantage of wireless networks.” Ubisense saw this as an opportunity.

Despite the significant growth in wireless network coverage, Ubisense’s customers also need to be able to run mission-critical applications, such as repairing an electric network, offline. Therefore, Ubisense put a lot of work into building a very robust capability to synchronize geospatial data offline, says Batty. This, he explains, is a challenge that has not been widely solved and commoditized and still requires a lot of development. Building a hybrid online and offline mode while keeping the data synchronized turned out to be more complex than he had anticipated.

Another key to mobile solutions is the ability to run on all the major mobile platforms: Android, iOS, and Windows. Ubisense’s large enterprise customers still have many people using Windows, for example on laptops in trucks, and they are also seeing a trend towards greater usage of Android and iOS tablets and phones. “We use a technology called Apache Cordova, also known as PhoneGap, to write applications using HTML and JavaScript. Then you can in effect compile that code to run as a local app on all of those three platforms, including any customizations that the customers or we ourselves might make,” says Batty.

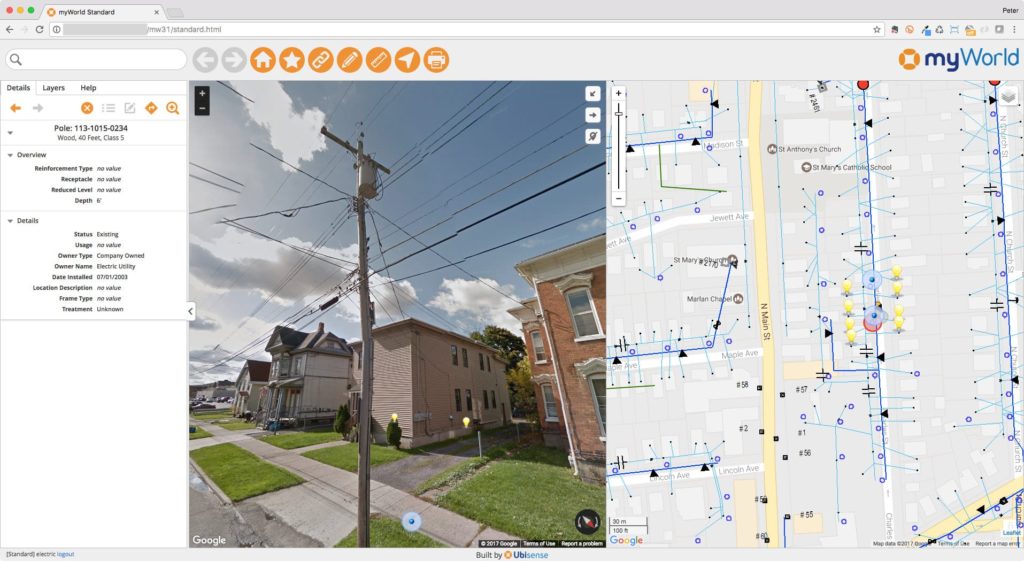

FIGURE 4.

myWorld with electric utility data, integrated with Google Street View, enabling the user to see details of equipment on the pole, courtesy of Ubisense

Ubisense provides “an application framework,” Batty says, that includes a base application that can run out of the box, arranged with standard features such as one box search, Google Map-style navigation, and Street View display. However, he points out, users can configure many aspects of it, including the data layers and certain aspects of the functionality, using a configuration user interface. Ubisense also provides users with an API that they can use to develop more complex additional functionality. “In general, we work with large customers and all of them tend to have some unique requirements, so it’s important to have this customization environment and also to have an approach that lets you deploy that to all of the different operating systems easily.”

Ubisense also uses its platform to deliver some specific applications, such as to enable electric utilities to assess damage after a storm and to help gas, electric, and communications companies to conduct inspections and surveys.

Batty agrees that the line between software vendors and data providers is blurring. While Ubisense mostly deals with data coming from its customers’ internal enterprise systems, it also makes it easy for them to integrate other data sources. “We support the Esri REST API and OGC Web services, including WMS and WFS,” he says. Even large enterprises that historically have been mostly focused on internal data now increasingly have access to external data, he points out. “We make it very easy to integrate that in.”

There are some parallels and some differences between Ubisense and Google Earth Enterprise (GEE). At least a couple of utilities, Batty says, have built solutions to allow them to visualize data from myWorld using Google Earth. However, he points out, the 3D aspect of it was peripheral. Ubisense provides a more Google Maps-style flat interface and does not support a spherical Earth visualization. “3D isn’t really needed for the great bulk of our applications,” Batty says. “In general, for us it’s useful to be able to run the app in a Web browser, because we deploy to very large numbers of users in an enterprise as opposed to having to install a client application.” For organizations that have been using GEE without fully leveraging its 3D capabilities and the sphere capabilities, “we provide something that is comparable and more customizable and that lets you take data offline more easily.”

HARRIS GEOSPATIAL SOLUTIONS

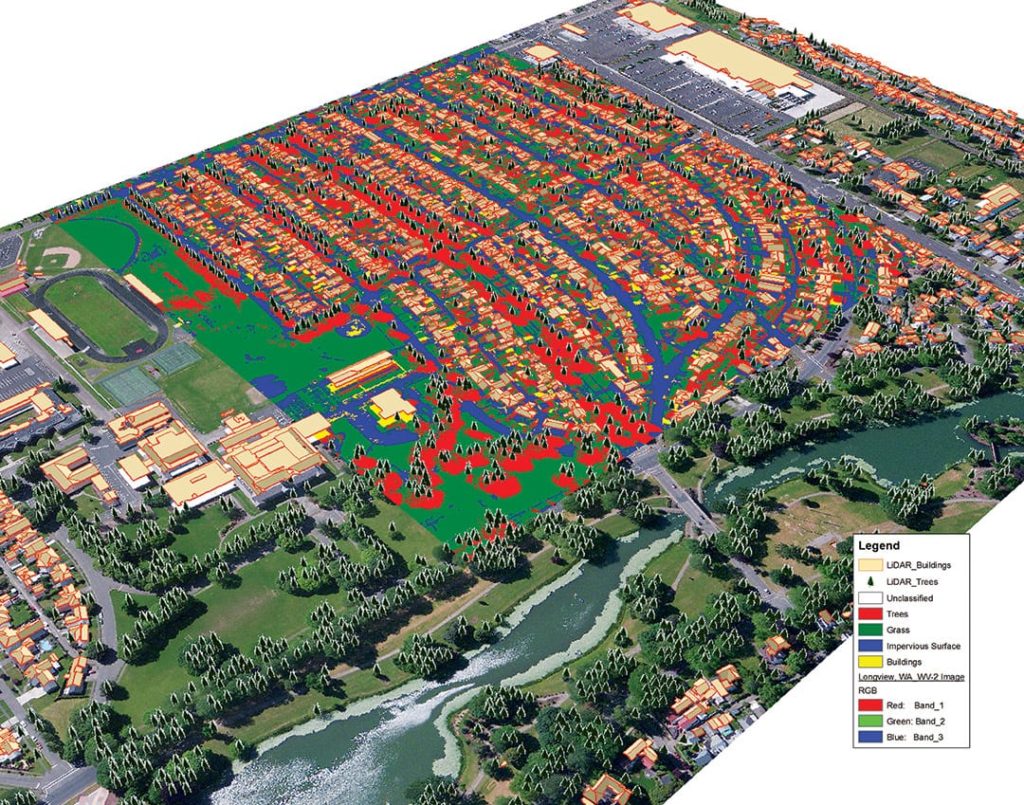

Harris Geospatial Solutions focuses on the use of geospatial technologies—including data, content management, exploitation services, and software tools—in both the private sector and the U.S. government. On the private sector side, Harris is investing in analyzing data from satellite imagery, mapping in 3D using airborne Geiger-mode LiDAR, and developing solutions for such markets as precision agriculture, utilities, and critical infrastructure.

To capitalize on the growth in demand for Earth observation (EO) data, Harris has partnered with DigitalGlobe and Esri to offer a subscription service they call AllAccess+Analytics. The service gives customers access to the entire DigitalGlobe archive, via DigitalGlobe’s Geospatial Big Data Platform (GBDX), and allows them to analyze the imagery using Harris’ ENVI analytics tool and Esri’s analytical tools. “We see the trend of delivering information as being really important towards achieving growth and profitability in the geospatial analytics market,” says Blundell.

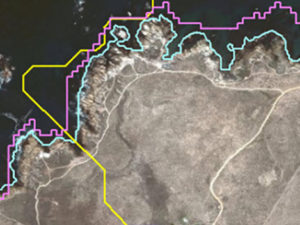

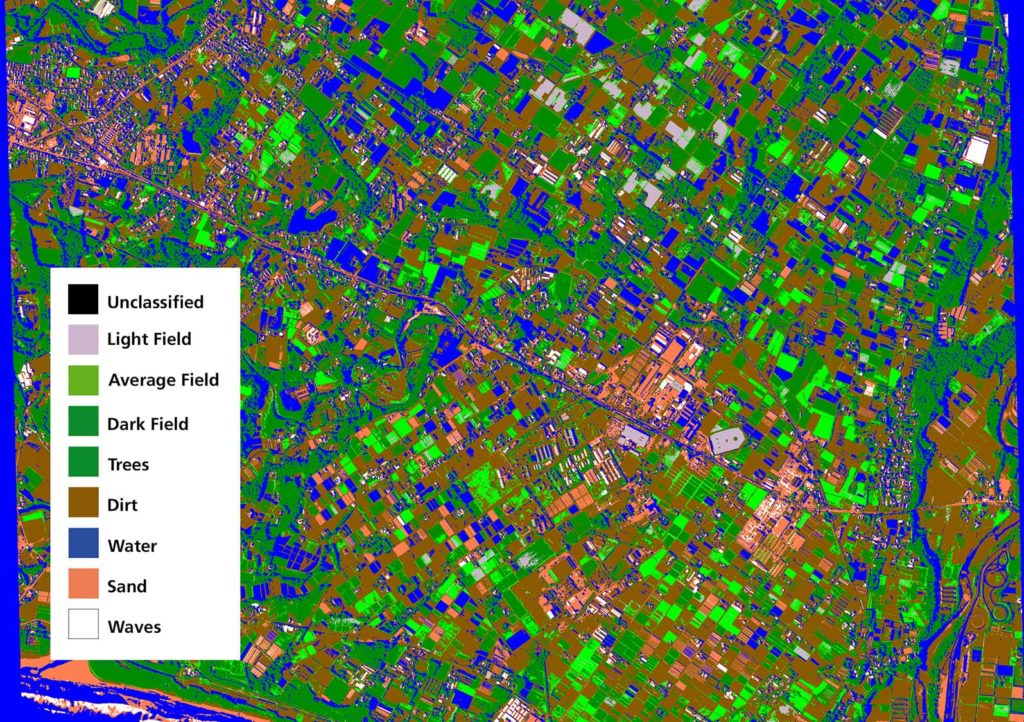

FIGURE 5.

An example of land-cover classification services with ENVI Analytics from the Harris Geospatial Marketplace

In 2015 Harris put on the market a wide-area LiDAR mapping technique called Geiger-mode LiDAR, previously reserved for military applications, which collects data with spatial resolutions on the order of 20-40 points per square meter. It can be used to collect high-resolution 3D imagery in both urban and natural environments, enabling users to visualize fine details and collect the attributes of features.

In February 2015, the company bought Exelis, a smaller rival that had been spun off from the ITT Corporation in 2011, and that developed the ENVI suite of remote sensing processing tools. According to Blundell, this put Harris “at the top of the remote sensing technology pyramid in terms of both engineering and manufacturing expertise.”

Harris also focuses on critical infrastructure, including utilities, transportation networks, ports, and harbors. The company is working with Canadian company exactEarth to support worldwide maritime ship tracking in near real-time, says Blundell. Harris supports its utilities customers with LiDAR mapping of both the transmission and the distribution portions of their networks, for asset management and disaster response. “We see the concept of persistence in remote sensing as adding value to a variety of vertical markets,” Blundell says. “Harris works with a variety of remote sensing platforms, including UAS, airborne, and satellites to provide full-spectrum remote sensing solutions.”

Blundell, too, agrees that in the geospatial market the distinction between software vendors and data providers is blurring. He sees this as a reflection of what is happening in all markets, namely that content is increasingly critical to attracting and retaining customers. He contends that his company’s online marketplace will become “the premier provider of geospatial content” for several reasons, including because it provides “a unique geospatial data broker service with content from more than 40 different geospatial companies,” including Airbus, DigitalGlobe, OpenStreetMaps, and smaller companies that provide vector data layers.

The second reason, Blundell says, is that it provides “data curation and custom product generation services” by integrating several data sources to meet each customer’s unique needs. To illustrate the importance of this, he points to questions about the quality of sensors when dealing with data from large constellations of small satellites. “What is the core imaging quality of some of these sensors? How do you reconcile quality metrics when you’re getting a stack of data from 15 different collections over an area of interest? How do you bring that data together into a cohesive, mosaicked image dataset?” He argues that Harris’ experience makes it especially qualified to address those issues and ensure quality. Additionally, he argues, Harris is particularly skilled at understanding how to extract information from space-based sensors due to its long experience with radar data and various kinds of sensors.

In the future, Blundell says, Harris may partner with large organizations, such as IBM, and smaller companies that can extract geolocation data from text and other social media feeds. “We see that as being an important part of the location-based information mix going forward.” The NGA and other U.S. government agencies are increasingly using open and commercial data sources and Harris, he argues, has a role in helping the U.S. government and its private sector customers find the right data to meet their mission requirements.

Harris does not provide a Google Earth-type enterprise software platform. However, to provide that capability to its customers, says Blundell, the company has always worked with such partners as Esri, with which it recently signed a new partnership agreement. He also cites a partnership with SARscape, a small company that builds commercial radar processing capabilities, which Harris integrates with its ENVI image processing software.

Harris, Blundell says, contributes to platforms like Google Earth and ArcGIS its expertise and reputation in the collection and processing of geospatial data, such as those from hyperspectral or radar imaging. Citing a comment that Lawrie Jordan made years ago when he was the president of ERDAS, to the effect that the map of the future is an intelligent image, Blundell foresees “an intelligent image where the information is fused into the scene.” Background search capabilities and machine learning, he argues, will automatically make available a variety of statistical information. “Increasingly, I see embedded intelligence within imagery as being the key towards getting revenue growth from the larger consumer market.”

FIGURE 6.

An example of Harris Geospatial Earth observation imagery with integrated 3D LiDAR data and image processing services

CONCLUSIONS

This series of articles has offered a panorama of geospatial offerings from 18 companies: Esri, VRICON, Google, Galdos Systems Inc., Skyline Software Systems, Onix Networking Corp., CartoDB, DigitalGlobe, Analytical Graphics, Inc., Mapbox, PIXIA, Luciad, BAE Systems, Earthvisionz, Hexagon Geospatial, PYXIS, Ubisense, and Harris Geospatial Solutions. While they each provide a unique set of products and services, these companies compete, partner, and overlap in that ever-changing kaleidoscope image that is the geospatial industry, displaying patterns soon to be replaced as technology and user expectations advance.