DigitalGlobe: Expanding Access to Insights from Satellite Imagery

AGI: Cesium Disseminates 3D Models

Mapbox: Enabling Developers to Build Custom Maps

BY MATTEO LUCCIO

CONTRIBUTOR

PALE BLUE DOT LLC PORTLAND, ORE.

www.palebluedotllc.com

This series of articles began in our Fall 2015 issue by focusing on the impact on vendors and users of geospatial technologies of Google’s decision to end support for Google Earth Enterprise (GEE). It has widened to present an array of new offerings that expand access to Earth observation data and give users new tools to analyze them. For this installment, I talked to John-Isaac Clark, Director of Product Management for Geospatial Big Data at DigitalGlobe; Todd Smith, Cesium Product Manager at AGI; and Matt Irwin, who handles business and government at Mapbox.

Cesium aircraft casts a shadow over Half Dome, in Yosemite National Park, California. Courtesy of Analytical Graphics, Inc.

1.1 million New York City buildings dynamically styled with Cesium 3D Tiles. Image courtesy of Analytical Graphics, Inc.

DIGITALGLOBE:

LOWERING THE BAR TO ENTRY

DigitalGlobe is launching a new platform, and new offerings: GBDX (Geospatial Big Data Platform), Maps API, crowdsourcing, and Spatial on Demand— plus AnswerFactory and the ArcMap Plugin as additional ways to consume these capabilities.

Until recently, Clark explains, non-remote sensing users predominantly used pixels as reference onto which to overlay vector data, such as areas of interest, state boundaries, or roads. For this reason, Google, Apple, Bing, and Esri became some of the major commercial purchasers of satellite imagery as users began leveraging their respective mapping products to marry vector and satellite data within Web, mobile, and desktop applications. Users then realized that they could buy these pixels, too. However, the cost—$10-$30 a square kilometer—and the size of the Earth’s landmass made this very expensive to do. Therefore, only the likes of Google, Apple, and national governments buy vast amounts of imagery and generally use it only as a basemap.

In particular, answering questions about change over time—such as finding every new road in a country—would have been extremely expensive, Clark points out. In addition to buying imagery from DigitalGlobe or others, it would have required downloading terabytes of this data, storing and

processing it, and then hiring Ph.D.-level remote sensing experts who would have had to employ high-end and expensive tools, such as ENVI or ERDAS, to perform multi-band analysis on the pixels. “Then, hopefully, at the end, after you’d spent quite a bit of money on software, people, storage, and processing, you might have been able to answer your question.”

However, Clark explains, recently the cost of storing and processing data have dropped dramatically— thanks in large part to cloud offerings by Amazon and Google—and the Internet infrastructure to transfer data has improved. Now, DigitalGlobe can allow users to query its 90 petabytes of imagery data of the surface of the planet, collected over 15 years, and extract answers and insights. On the back end, machine learning techniques can analyze the data at scale, inside a cloud infrastructure. “Let’s let people rent the pixels to get these answers, instead of having to pay to download them and build their own infrastructure,” says Clark.

NEW PLATFORM: GBDX

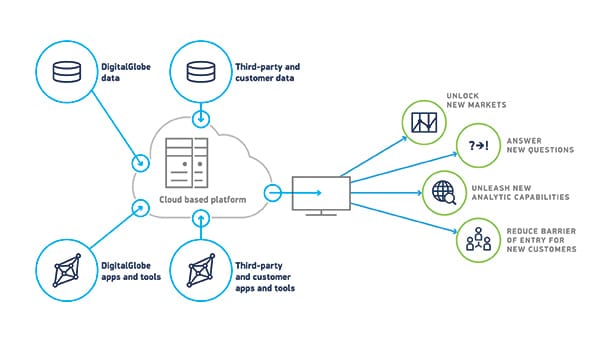

To this end, DigitalGlobe is launching GBDX, a Web-based platform that allows users to access its entire archive of data for the purpose of running analytics on the data in the cloud. “With this approach,” says Clark, “we can drastically reduce the costs. Through Web services and with storage and process- ing hosting on Amazon, anybody who wants to use it in their applications does not need to build their own infrastructure. They don’t even, in some cases, need to know what remote sensing is.” See Figure 1.

GIS users can now do this directly from ESRI ArcMap via a GBDX plugin. For example, they can request to be notified whenever a satellite image of their area of interest is captured and then perform automatedfeatureextractionatscale.“Tell me if there is a new building, a car, a new road,” Clark explains. “That is what is incredibly exciting and very powerful about doing remote sensing on planetary-size data and making it accessible to everyone.”

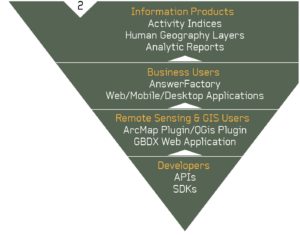

THE INVERTED PYRAMID

What knowledge, skills, and tools users need to ask those questions depends on who they are. Clark uses an inverted pyramid to explain this. At the base are developers, who access the DigitalGlobe platform via APIs and SDKs. “Organizations like SpaceKnow or Orbital Insight, which know remote sensing very well and are also very conversant in software development and Web programming languages, are at the base. They have core access to the platform and can make it do whatever they want.” Such users can find data in DigitalGlobe’s archive catalog, order it, create new workflows and algorithms, download the data to Amazon, etc.

A step up from the developer tier is that of remote sensing and GIS professionals, who traditionally have been in separate camps. They can access the GBDX platform via, for example, plugins that DigitalGlobe has developed for ESRI ArcMap and QGIS. See Figure 2.

Remote sensing experts who are not familiar with those applications can access the platform via the GBDX Web application, which lets them cull through the type of data that they might need to run their algorithms and leverage pre-built ones—including those in the Harris ENVI remote sensing algo- rithm suite. For example, if a user searches for Eureka, California, the GBDX catalog service returns 3,000 images. They can sort them by such things as the type of content, resolution, off-nadir angle, and cloud cover.

While remote sensing experts often output from raster data to raster data, for GIS experts it is typically more useful to output vectors. This allows them to ask such questions as, “How many cars were in San Francisco today within 500 meters of Kezar Stadium? We can answer that.”

EXPANDING THE USER BASE

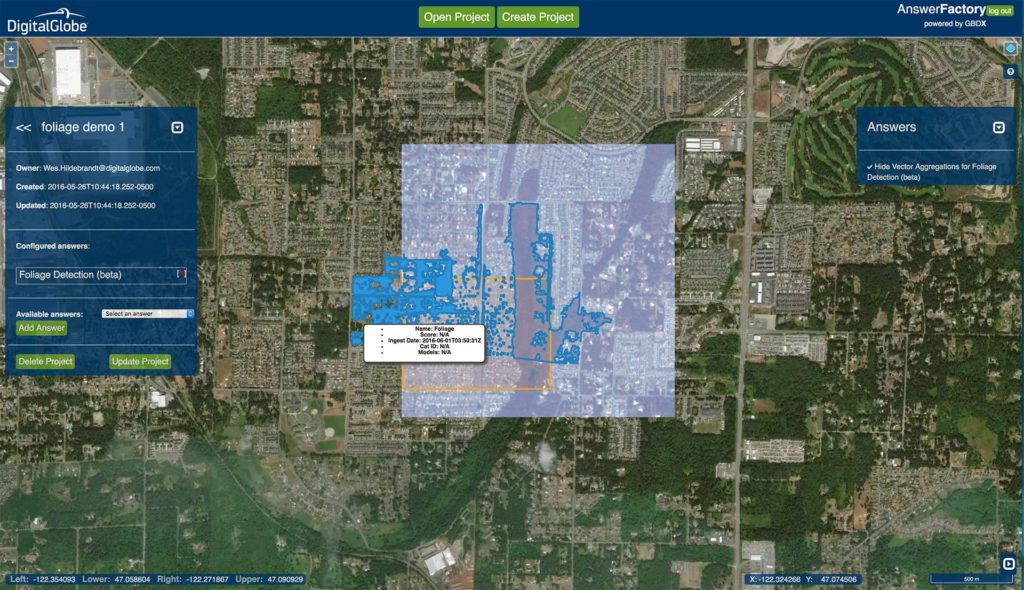

Clark is especially interested in bringing these capabilities “to the people who have never even heard of DigitalGlobe, who don’t know what raster is.” This brings us to the next level of the pyramid: business users who access the platform through applications such as AnswerFactory, which is powered by GBDX. These users simply define areas of interest and then ask the platform what it can tell them about these areas. “If I selected the Dallas airport and for every satellite image of it asked it to count airliners, that would be really interesting,” says Clark.

Many of the back-end processes that these tools leverage run “extremely advanced, machine

learning, based on AI (artificial intelligence) convolutional neural network approaches,” Clark explains. One of the object detection methods available in AnswerFactory has been trained on millions of different views of airplanes. However, a business user does not need to know what a convolutional neural network is or how to manage the complexity of training it, in order to take advantage of its capability.

By selecting “suburban roads,” a user can extract roads from the latest version of the satellite imag- ery from DigitalGlobe’s catalog with the least cloud coverage. “Users don’t have to understand material selection or know what off-nadir is. They ask their question and we get the best and most current shot to generate the answer,” Clark says.

DIFFERENT FRONT ENDS

The question has long been how to inexpensively access the data that Earth observation satellites con- stantly rain down from the sky. GBDX has different front ends, depending on the user. Developers will build on the GBDX capability using the API, which Clark calls “the basement of the platform.” Above this level, integrations with existing desktop tools, such as ESRI’s ArcMap, will allow users to query or operate GBDX algorithms and bring the resulting data into their desktop tools and environment. Business users who do not understand the underlying science or technology will use AnswerFactory.

What are the cost and learning curve for the occasional, non-specialist user? While DigitalGlobe began with predominantly developers using its platform, now it is focusing on enabling other users as well. “We want more companies to be able to build and feed these exciting new use cases to other users as well,” says Clark. “But it is equally important that we begin to explore how we can monetize these new capabilities in such a way that what we are charging businesses and organizations is commensurate to the value that we are creating for them.”

THE MAPS API

“DigitalGlobe is not looking to bring to market a replacement for GEE or a 3D visualization product,” says Clark. “However, we are supporting some very interesting development of people who are creating 3D content or extracting 3D datasets from our 2D satellite images.” For example, he points out, VRICON, a joint venture between SAAB and DigitalGlobe, is processing DigitalGlobe data and creating 3D products, which can be displayed using the VRICON Explorer products, or potentially within other 3D visualization environments. (Editor’s note: VRICON was featured in Part 1 of this series, Fall 2015.)

Not every potential user can afford to pay $30,000- $500,000 a year to take advantage of the full range of GBDX data and services at the developer tier designed for organizations to build their own products. Therefore, Clark explains, his company is exploring market-specific solutions prepackaged to leverage the platform’s capabilities. “What would you pay if you could monitor your assets and receive an alert any time DigitalGlobe takes a satellite image and it reveals signs of human activity anywhere near your infrastructure?”

DigitalGlobe is also talking to other providers of Earth observation data about bringing them into GBDX. It recently acquired Spatial Energy, whose Spatial OnDemand product gives energy business users access to both raster and vector data. Going a step further, Clark sees new DigitalGlobe product offerings to support multiple industries.

Unlike Google’s, Bing’s, and Apple’s mapping APIs, DigitalGlobe’s new Maps API provides rights in its licensing terms to make derivative products. It also provides a license option that allows users to download some of that data for offline use. Maps API launched in August 2015, with the self-service marketplace launching in April 2016.

While Mapbox purchases DigitalGlobe imagery and provides it to their users through the Mapbox API, they are also a business partner. “We partnered with Mapbox to launch our Maps API and make it available via their infrastructure, so that we can offer our users an SLA with a 99.999% uptime that Mapbox’ infrastructure supports.”

The point, Clark says, is not to compete with Mapbox, Google, or Bing. “We are not doing directions, traffic, or navigation,” he points out. Rather, the API enables users to see all of the company’s most recent and cloud-free imagery to use in applications without these developers having to buy, download, and host the raster data.

Finally, DigitalGlobe’s acquisition of Tomnod and its partnership with Geohive allows the company to incorporate crowdsourcing into its platform.

AGI’S CESIUM:

DISSEMENATING 3D MODELS

Since its founding in 1989, AGI, an aerospace engineer- ing software company, has focused on displaying highly accurate physics-based models. “Visualizing very complex objects over space and time has always been important to us and to the users of our software,” says Smith. “At the core of that, 3D has always been very important.”

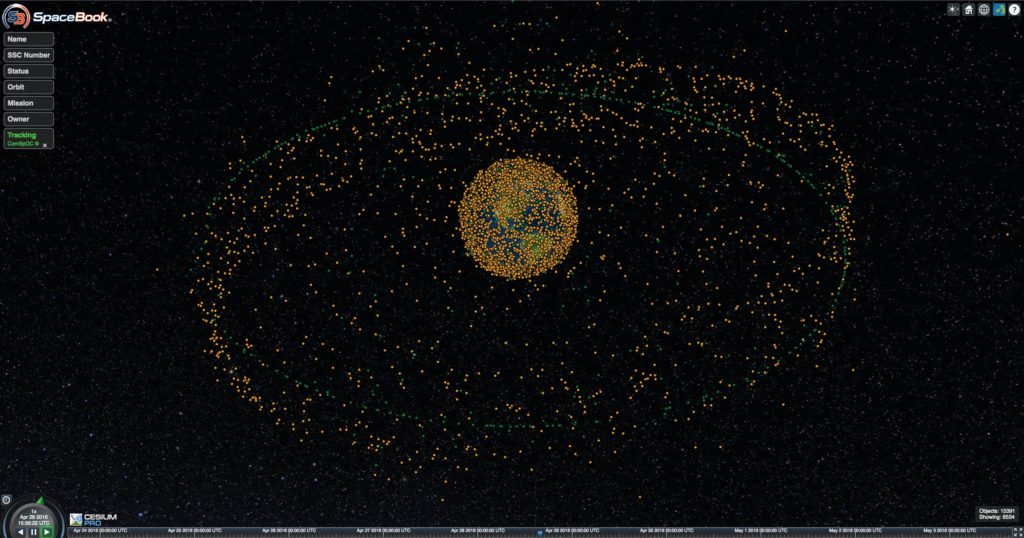

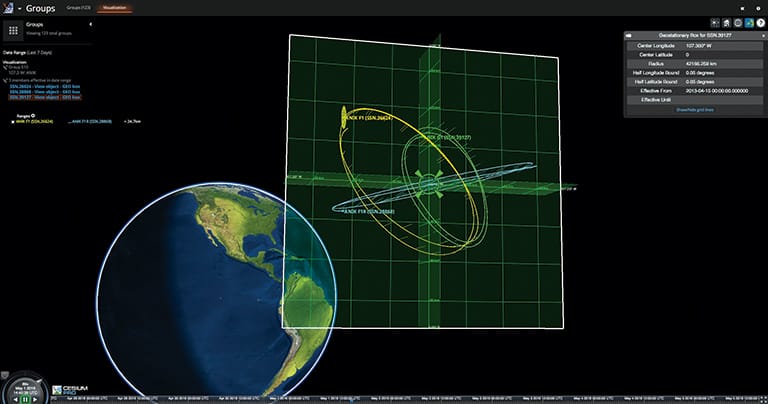

FIGURE 3. Time-dynamic, highly accurate 3D visualizations depicted in AGI’s Spacebook, showing space situational awareness for ComSpOC. Images courtesy of Analytical Graphics, Inc.

FIGURE 4. 15,000 objects being fed realtime into Cesium for time-dynamic and 3D visualizations. Courtesy AGI.

In 2012, AGI started the Cesium project. “The initial motivation was to be able to take those time-dynamic aerospace models and put them out over the Web without a plugin, so that people could view them, share them, and give them to their stakeholders,” Smith explains. The company made a big bet on WebGL, which was then an untested technology. “As WebGL grew, and as major software vendors adopted it, this has paid off for Cesium, which is all built out of WebGL.”

AGI decided to open source Cesium and it has been getting “viral adoption” in many different industries, says Smith. “We are focused on people and industries who are interested in being able to disseminate large amounts of heterogeneous data over the Web in 3D. Customers are telling us how they use Cesium in many different markets and unexpected ways.”

Equally important, Smith says, is “viewing time as a first class citizen.” As objects move in space and time, that is where Cesium really gets to shine, he says. “Cesium also works quite well with many different data types and streams them over the Web. It seamlessly handles transformations from Earth-center fix to an inertial frame, which derives directly from our aerospace roots.” DigitalGlobe’s Maps API is Cesium-compatible.

NEW OPEN FORMATS

At its core, Cesium is an SDK with which users can build implementations. It comes with a viewer, which many users employ to import their favorite map service or implement their KML data. AGI has done a lot of work with data formats, Smith points out. “This goes back to some of our core capabilities, because rendering traditional 2D formats effectively in a 3D scene is really complex, particularly if you are dealing with lots of data.”

Hence, in parallel with Cesium, AGI has also developed four open formats: CZML, quantized mesh, glTF, and a new emerging format called 3D Tiles. “We expect these to become standards one day and not just open 3D formats,” Smith says. “3D Tiles is able to stream massive amounts of heterogeneous data over the Web into a client like Cesium. We are developing server-based products that are able to take users’ traditional formats and convert them into formats that stream really well over the Web into a 3D browser.” At the beginning of May, AGI announced cesiumjs.com, an online offering 7 that can be used behind firewalls and on private networks.

Cesium is a business unit within AGI and the primary contributor to the Cesium project. “We provide a lot of input to the project, because other business units at AGI are really good users of Cesium,” says Smith. “AGI has built solutions such as ComSpOC (Commercial Space Operations Center), as well as GLADS, on top of Cesium.”

MAPBOX:

CLOUD-BASED GEOSPATIAL STACK

Mapbox began as a custom mapping consultancy. “We were building maps and visualizations for NGOs and governments in the development space, in the mid-and late-2000s,” says Irwin. The company, he recalls, would do such things as take 30,000 pages of PDF elections results from Afghanistan and build maps and visualizations that would help spot provinces where fraud had likely occurred or instances of violence that had potentially reduced voter turnout at the ballot box. “Eventually, we realized that we had to build many of the tools that we used to build these maps and that building the tools and turning them into a platform was an equally interesting business model.”

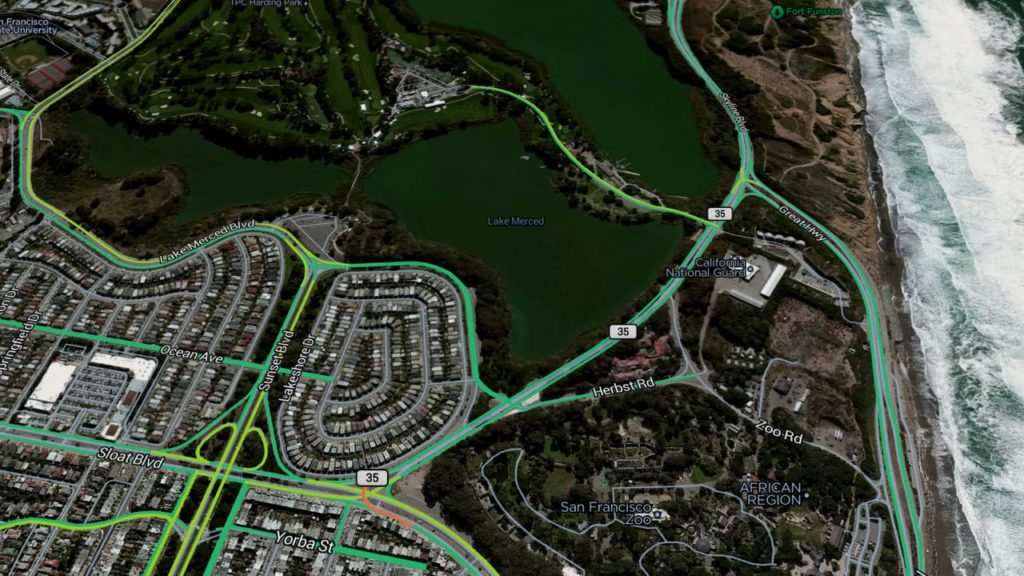

FIGURE 7. Mapbox takes high-resolution imagery, including from DigitalGlobe, and adds context, like roads and labels.

A decade later, Mapbox now has a cloud-based geospatial stack that offers all of the traditional map and location-based services that a developer would need to build a custom map for geospatial apps. “We offer everything from heavily curated basemaps to map and data design tools to directions matching to geocoding, via a set of cloud APIs and open source libraries and tools,” says Irwin.

“Mapbox is a foundation for other platforms,” says Irwin. “People will hit our cloud APIs, use our services, and build them into their own applications. You will never see a Mapbox app on your phone, but we will power apps ranging from Foursquare, which lets you check in at a restaurant you visit, to Strava which tracks your runs, hikes, and bike rides.”

SUPPORTING OPENSTREETMAP

Mapbox believes that, over the long term, open data will be the most complete, up-to-date, and sustainable source of mapping data. “We always prefer using open data first and then contributing back to open data communities,” says Irwin.

Probably the biggest community that Mapbox touches is OpenStreetMap (OSM). When OSM began, more than a decade ago, it was not taken seriously as a potential commercial mapping solution. It has since grown to rival the best available commercial map datasets and to surpass them in many parts of the world, especially in the developing world. “Mapbox’s involvement there starts by building some of the tools that are used by these communities to add or process data,” says Irwin. “For example, we built iD Editor, which is one of the popular tools that is used to trace roads and buildings in OSM.”

Mapbox has also contributed to several of the geospatial tools in the imagery space, such as Rasterio, a popular tool used to manipulate and analyze raster imagery. The company also works with education and training, such as by publishing the documentation it uses to build its toolsets and holding map-a-thons so that anyone can learn how to use mapping tools.

THE ROLE OF COMMERCIAL DATA

Mapbox will also continue to purchase commercial data, such as from DigitalGlobe, “until the open datasets can rival the strength of some of the highly curated commercial datasets,” says Irwin. Its platform is data source-agnostic, so that its users can bring in their preferred basemaps. “We can process their commercially-licensed datasets into a map for them. For example, we did this for MapQuest, which wanted to use the TomTom data that it had licensed. We were able to process that and turn it into a seamless map experience served out by our APIs.”

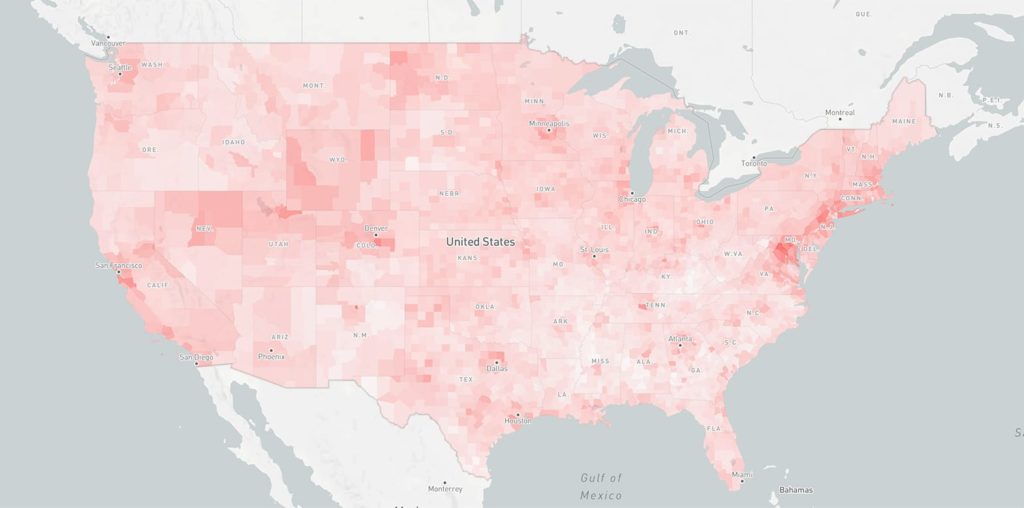

FIGURE 9. Mapbox maps and libraries combine to build interactive data visualizations, like this choropleth map of income and population in the U.S.

The high resolution satellite and aerial imagery on Mapbox’s basemap comes from DigitalGlobe, with the exception of some open ortho imagery, says Irwin. “We also helped DigitalGlobe put together their Maps API, which changes the way they are able to deliver pixels to their customers. Rather than having to ship large num- bers of zipped geoTIFFs or put a hard drive in the mail, developers and imagery analysts can access this imagery as tiled maps via an API end point that we have built on behalf of DigitalGlobe.”

Mapbox also employs a bring-your-own-data model for data types that its platform does not serve natively. People have used it to build maps for 3D building extrusions or photogrammetry or to import oblique imagery for damage assessment after tornadoes or cyclones.

For DigitalGlobe’s Maps API, Mapbox hosts imagery on behalf of DigitalGlobe and serves it out via its API. “Mapbox is a foundation for all the other platforms,” says Irwin. “They own the curation of the imagery that is being served out over the APIs and the entire experience around integrating that into other tools, such as GBDX. It is something that we built and serve in the background but feels like a DigitalGlobe experience to a user. Mapbox has the platform and DigitalGlobe has the data and putting the two together just made sense.”

People use Mapbox’s ability to host and manipulate imagery on platforms for things like time-series comparisons for tracing and feature extraction from imagery into vector data. While the company is not working on a massive automated feature extraction pipeline, Irwin points out, its Maps API work with DigitalGlobe allows users to push a large amount of imagery to a platform like GBDX very quickly, without requiring a lot of spatial format manipulation. “We focus on enabling those kinds of analyses, rather than on building the actual operator that would perform that kind of work.”

While Mapbox does not provide a viewer similar to Google Earth, its GL and WebGL framework

underpin most of the globe-based technologies, says Irwin. “You can absolutely take Mapbox raster or vector tiles and wrap them on a globe. There are some commercial implementations that use Mapbox and Cesium.” Irwin describes a tool chain that begins with DigitalGlobe’s WorldView-3 beaming down 30-cm imagery of Central Africa; those pixels, as geoTIFFs, are then pushed through DigitalGlobe’s processing tools and then into Mapbox’s imagery pipeline. “We turn that into tiled maps, which are hosted on our infrastructure and served through our APIs. Some Cesium users point their globe implementation at those APIs and suck in these tiles and overlay them on a Cesium globe that is using Mapbox terrain for elevation or Cesium terrain for elevation. That’s a really good example of how those three technologies play together. We just think of ourselves as the geospatial plumbing.”

GBDX, Cesium, and Mapbox are very different but complementary platforms. They are making

geospatial data and technologies accessible to an ever-growing number of users. As this series continues, we will explore additional geospatial platforms, capabilities, and use cases.