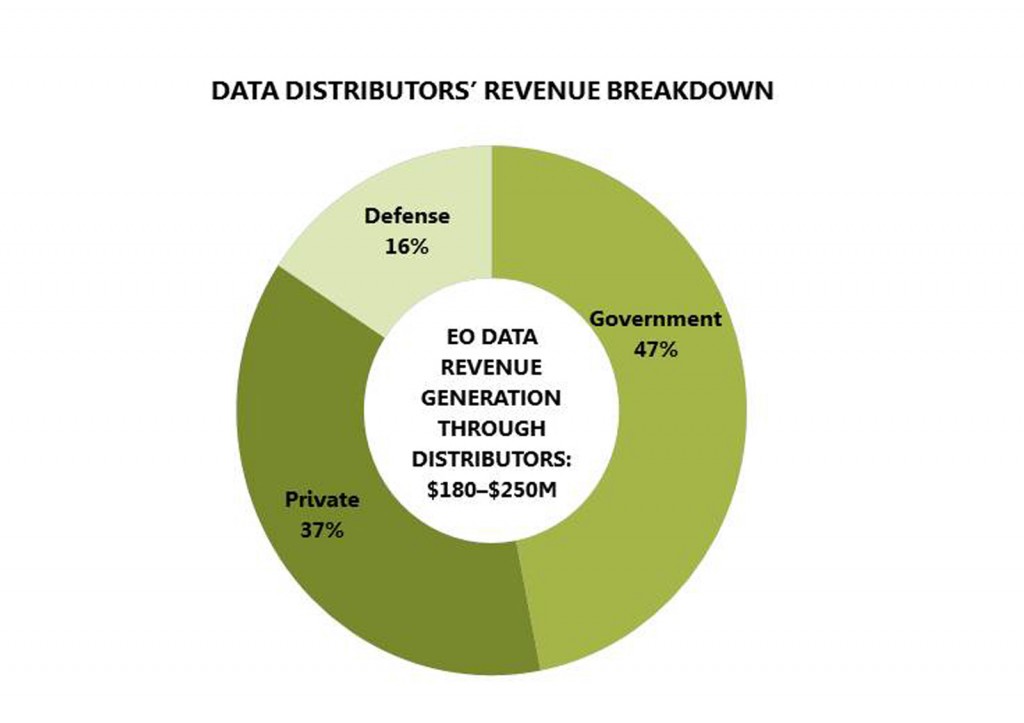

According to Euroconsult’s new research report, “Earth Observation: Data Disribution – Profiles, Strategies & Trends,” an estimated 12-17% of the $1.5 billion commercial data market flows through the distributors of EO satellite operators. While this percentage may seem low, it should be recalled that the majority of the total market is to defense end users (65%) who usually prefer a more direct approach to receive imagery. Business for the data distributor reflects this, with a far greater emphasis on enterprise (civil and private markets). See Figure 1.

FIGURE 1.

Data Distributors Customer Mix. Note that the low number for defense is

misleading, because most defense users do not use distributors to get their data.

Revenue through data services from the distributors is first from civil governments, totaling 47% of distributor data business. This highlights the need to be local in accessing civil contracts, an important consideration given the growing demand globally for EO solutions – particularly in fast-growing regions (for instance in Southeast Asia, Latin America) with a strong civil mandate to support resource monitoring, engineering and infrastructure projects, etc.

Data provision to the largely data-agnostic private sector through distribution is also disproportionately higher than the total data market, representing 37% of the distributors business. The relatively small figure of 16% data revenues associated with defense users demonstrates the more direct approach preferred by this user community. Most operating companies with very high-resolution satellites offer direct receiving stations (DRS) solutions to defense end users in order to meet their requirements of short delivery time, and secure, continuous data supply with degrees of autonomy in satellite tasking and data acquisition.

EO satellite operators recognizing the different procuring attitudes of end-user sectors are quick in establishing partnerships with distributing companies. As of today, over 550 agreements are in place between operating entities and data distributors globally. In the past, commercial operators significantly

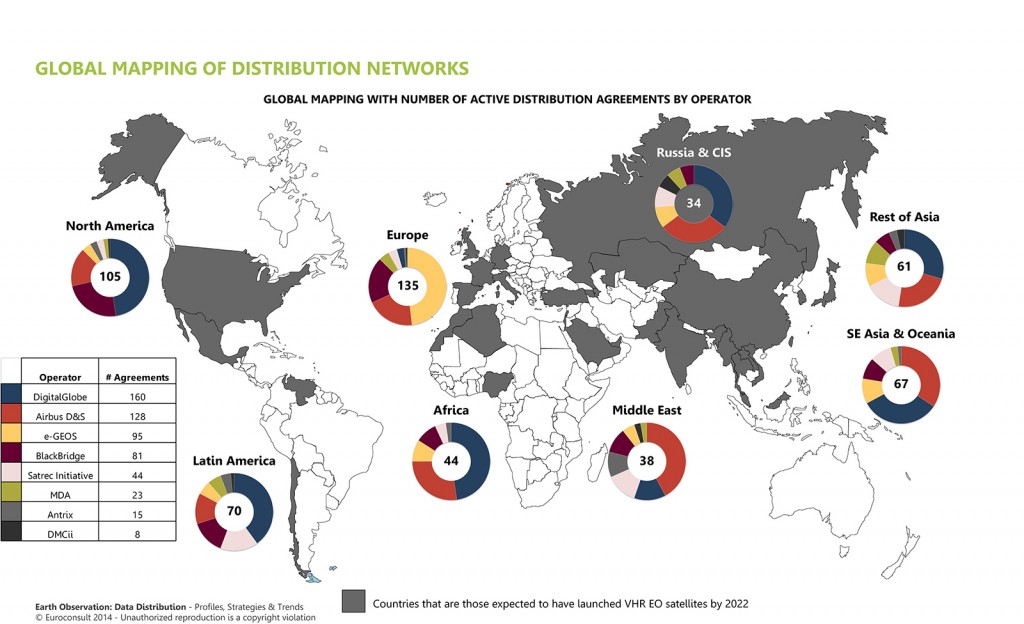

developed their networks in fast-growing regions that demonstrate a strong potential for commercial growth but with limited national high-resolution data supply. Operators have since shifted their focus to reemphasize the home markets; this could indicate that distribution networks that are currently in place in regions like Latin America, Africa, and Southeast Asia and Oceania are now sufficient to address these regional markets. See Figure 2.

The clear advantage for an operator in establishing partnerships with data distributors is access to local markets. As previously stated, civil government is the primary customer sector for the distributors, and, since governments are nominally mandated to support its national industrial base, this is not viewed as a surprise. However, it is not just a question of “being local.” Further advantages include understanding local customs and procedures, including the language barrier; and being present in order to monitor Requests for Proposals (RFPs), and to lobby the procurement departments of the administrations ahead of the RFPs’ issuance. In certain cases, the RFPs are reserved for local companies.

In many administrations, the suppliers have to be referenced first to be allowed to place a bid. Such referencing may represent time and money for the operating company. Distributors can more easily filter the requests from potential customers and, therefore, save significant time for the operator’s customer services.

Distributors also stress the importance of being in “proximity” to end users. That proximity is not only geographical, but also in terms of expertise and technological culture: sharing the same vocabulary and understanding the end user’s actual usage of the data. Further motivation for the operators to establish a distribution network includes securing guaranteed revenues from exclusive resellers, implementing a presence within a country without dispatching their own staff, and obtaining access and clearances to foreign national governmental business.

Operators tend to organize their distribution networks in regional coverage, with a higher density of resellers over active national markets. In such cases, they may even assign several vendors to the same geographic territory but with different market segments, thus avoiding the creation of internal competition within their networks. Although specifics vary between the satellite operators, a broadly similar approach is taken.

Distribution mechanisms include partnering or forming alliances with:

Data Resellers: They procure data from the operators and resell them to the end users. Their main value is in their proximity with the end user: whether they have a lobbying influence or are pushing for the suitable specifications from the customer, whether they speak the language and know the customs of the end user, or whether it is simply that the end user statutorily has to buy from a local company. Value-Added Resellers (VARs): From the data they procure from the operators, they derive products, which they sell to the end users. Their value may reside in their capacity to offer an original product and/or in their proximity with the end user in a similar way to the data resellers. Exclusive Distributors: Commercial operators have included in their network data resellers or VARs that have a privileged status; they are committing to minimum buying. In exchange, several advantages are offered: closer support from the operator technical, marketing, and sales teams; higher discounts on the international price list; and the right to set up their own sub-distribution network. Business Partners: In synergy with the development of new big data and cloud and streaming technologies, the operators are starting to use such technologies to disseminate their data and promote their use. Products like those of Esri, Hexagon’s ERDAS, and Pitney Bowes’ MapInfo may propose to their GIS users streaming access to imagery databases; corresponding agreements with operators are de facto distribution agreements. Direct Receiving Station Partners: DRS contracts are considered to have the highest value and guarantees for the operator. They are mainly targeted toward defense users that require a greater level of data acquisition on demand and a degree of autonomous and secure access to data, and toward users requiring a very large quantity of data.The data distributing companies themselves are predominantly small-to medium-sized structures. In total, 40% consider data distribution as their primary business. Other activities are connected to applications development, value-added products (such as Digital Elevation Models), or value-added services (such as change detection monitoring). Data distribution is seen as a way to meet customers’ expectations and to complement their other business offerings.

Areas of activities are spread over all EO market segments, though sectors, such as defense, and more emerging sectors, such as LBS, are underrepresented. End users in these domains wish to deal directly with the satellite operators, whether for confidentiality or cost-effectiveness reasons.

The primary reasons for why geospatial companies enter the data distribution business are to better respond to clients’ needs and to be in a position to offer integrated solutions. The offer of a fully integrated solution reflects a wider EO trend in which users request a complete solution, or indeed the final information product. Any supplier taking care of ordering the data, processing it, and delivering a value-added product can build a more cost-effective offer and take a stronger market position than pure value-added companies buying data from a third party in order to build the service. In addition, data distribution companies that are also value-adding companies hold an added advantage of having in-house expertise on target application areas.

For these companies’ data-sale business, three fac- tors stand out in influencing sales:

Diversification in supply: The time when users had to wait for the availability of IKONOS very high- resolution data or Spot 5 high-resolution data is gone. Acquisition capabilities in both very-high (sub-meter) and high resolution data have grown significantly with distributors having multiple choices in order to meet end-user demand. Higher resolution: Improving ground resolution provides a higher level of detail that has helped distributors create opportunities to serve new domains of applications, especially in replacing aerial photography with easier-to-get, cheaper satellite imagery. Timeliness for delivery: Recent improvements in producing and delivering data shortly after acquisition have opened the door to strong improvement of monitoring applications. Automation of production and delivery certainly also contributes to this success.Despite these positives, however, challenges remain in the link between operators and distributing companies impacting both levels of the value-chain, in particular:

Licensing restrictions: Many of the distributors’ customers would like to purchase the owner- ship of the data so as to be able to do whatever they want with it (such as share with partners). National regulations imposed on the operators (such as the inability to sell sub-.5-meter ground resolution imagery) are considered further blockages for sales and services development. Competition from operators: Some distributors have the feeling that operators may favor direct sales rather than utilization of the network. Competition is not only focused on the Web portals of the operators; certain operators, for instance, tend to answer large RFPs directly without going through their distributor.Somewhat surprisingly, competition with national government systems is not viewed as a major concern. Indeed, national programs are seen more as stimulating the market than endangering the distributors’ position, the main argument being that the national program increases overall data availability and provides access to further end-users, hence making the overall business more secure and more sustainable. However, although not all of countries launching EO satellites are commercializing data from the systems, some attrition in the national usage of commercial data could be expected.

Concerns do also remain on the intent of the respective national programs. Certain distributors are concerned with either low pricing of national EO program data, and even greater concerns would arise if the data were to become free, at least for national government users, which make up the bulk of distributors’ customers. In such cases, the growing national competition could inhibit growth in certain sectors that can make do with lower cost data at lower ground resolution with less of a constraint on timely delivery.

ABOUT THE REPORT

“Earth Observation: Data Distribution – Profiles, Strategies & Trends” gives an assessment of the distribution level of the Earth observation value chain. It is the first research report to explore the connection between operators and distributors, and the advantages and challenges in expanding the operators’ geographical footprint and in reaching out to the largest potential number of end users through partnerships. It considers both the organization strategy developed by the satellite operators and the viewpoint of the distribution companies.